You check the net pay, shrug, and swipe away.

But those tiny abbreviations on your pay stub? That’s where real money can leak out through errors or mismatches.

One missed mistake can add up to hundreds—sometimes thousands—over a year. Let’s translate the jargon so you can spot issues fast and keep more of what you earn.

How Pay Stub Deductions Work

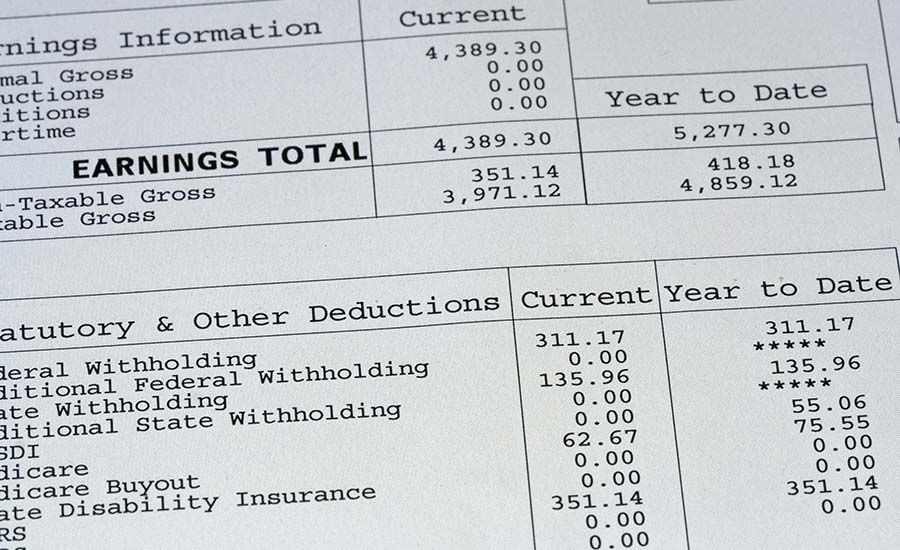

Every paycheck starts with gross pay (your total earnings for the period) and ends with net pay (what hits your account). Between those two numbers, your employer and payroll system apply deductions:

Required taxes (federal, Social Security, Medicare, and often state/local)

Benefits and savings (health insurance, retirement contributions, HSAs/FSAs)

Other items (union dues, wage garnishments, charitable donations)

Each deduction typically appears with a short code. These codes aren’t standardized across all employers, which is why they can feel cryptic.

Pretax vs Post-Tax: Why It Matters

Pretax deductions lower your taxable income first (e.g., traditional 401(k), many health insurance premiums, HSA/FSA). Result: you may pay less in income tax now.

Post-tax deductions come out after taxes (e.g., Roth 401(k), some voluntary benefits, garnishments). Result: no immediate tax reduction.

Understanding which bucket a deduction falls into helps you verify totals and avoid surprises at tax time.

Common Pay Stub Codes (Plain-English Guide)

Note: Your employer may use variations (e.g., “FIT” vs “FED TAX”).

Taxes

FIT / FED / FED TAX — Federal income tax withheld

SIT / STATE / STATE TX — State income tax withheld (if applicable)

LIT / LOCAL / CTY / MUNI — Local/city taxes (if applicable)

FICA — Social Security + Medicare umbrella term

SS / OASDI — Social Security tax withheld

MED / MEDICARE — Medicare tax withheld

Benefits & Savings

401K / 403B / 457 — Retirement plan contributions (often pretax)

ROTH 401K — After-tax retirement contribution

HSA — Health Savings Account contribution (pretax)

FSA / HC FSA / DC FSA — Flexible Spending Accounts (health or dependent care)

MED / MED INS / HLTH — Medical insurance premium

DENT / DENTAL — Dental insurance premium

VIS / VISION — Vision insurance premium

LIFE — Life insurance premium

STD / LTD — Short-term / Long-term disability premium

Other Common Items

GARN / GARNISH — Court-ordered wage garnishment

UNION / DUES — Union dues

CHAR / GIVE — Charitable contributions via payroll

PTO / VAC / SICK — Accrued/used paid time off (not a deduction, but appears alongside earnings)

Key Labels

GROSS — Pay before any deductions

NET — Take-home pay after deductions

YTD — Year-to-date totals for each item

PERIOD / PAY PERIOD — The date range this paycheck covers

YTD Boxes: Your Built-In Audit Trail

Every pay stub should show YTD (year-to-date) numbers for earnings, taxes, and deductions. These totals help you:

Confirm that taxes withheld to date make sense for your pay and W-4 elections

Check retirement/benefit contributions against your goals or plan limits

Spot anomalies when a code suddenly spikes compared to prior pay periods

If something looks off, compare this period vs YTD. A sudden jump can reveal a one-time correction or a persistent error.

Quick Check: 5-Minute Pay Stub Audit

Match the basics: Confirm hours × rate (or salary ÷ pay periods) equals gross pay.

Scan taxes: Ensure FIT, SS/OASDI, and MED are present and plausible. (SS usually 6.2% up to the annual wage base; Medicare 1.45% with potential surtax for high earners.)

Spot pretax savings: Verify your 401k/HSA/FSA amounts and YTD totals.

Benefits sanity check: Medical/dental/vision premiums should be consistent unless you changed plans.

Compare YTD: Look for unexplained jumps in any single code; review last pay stub for changes